5 EASY Ways to ORGANIZE Your FINANCES Will Make Your Money SPARKLE!

Miss Cee can attest to THAT herownself.

You’ll save not only time but also stress. You might even save some money.

Which you can then spend on bling.

5 Easy Ways to Organize Your Finances are Simple-ish and Rewarding

The monthly bills are a DISASTER for most of us because we don’t have the first good-gawd clue what’s going on.

We’re hoping that by winging it our finances will magically be A-Okay.

Not living under a bridge by tax time? Well, we must be doing something right.

Not so fast, poppets.

For every minute spent in organizing, an hour is earned.

Benjamin Franklin

You may not end up on a C-Note, like Uncle Bennie. But you’ve got something he never had. A computer.

And online banking.

For every minute you spend organizing YOUR monthly finances you’ll prolly save an entire DAY.

Ah, the power of modern efficiency.

Take the bull by the horns, the Benjamins by the Franklin, and breeze through the same 5 EASY ways Miss Cee uses and organize YOUR monthly finances.

You’ll get that sparkly fresh feeling of satisfaction that only comes from putting things PERFECTLY in order.

Table of Contents

- 5 Easy Ways to Organize Your Finances are Simple-ish and Rewarding

- 5 Easy Ways to Organize your Monthly Finances STEP 1: Look at How Much Money You ACTUALLY Have Each Month.

- 5 Easy Ways to Organize your Monthly Finances STEP 2: Budget by Getting an Online Bank that Allows Multiple Accounts.

- 5 Easy Ways to Organize your Monthly Finances STEP 3: Automate Your Account Transfers and Your Bill Payments.

- 5 Easy Ways to Organize your Monthly Finances STEP 4: Use Your Debit or Credit Card the Right Way.

- 5 Easy Ways to Organize your Monthly Finances STEP 5: Budget for Fun and Tidy Your House.

- 5 EASY Ways to ORGANIZE Your Monthly FINANCES Conclusion

5 Easy Ways to Organize your Monthly Finances STEP 1: Look at How Much Money You ACTUALLY Have Each Month.

Yulia Pantiukhina

Yulia PantiukhinaTake a Good Hard Look at Yerownself and Your Money. And Miss Cee means a GOOD. HARD. REALISTIC. LOOK.

Credit cards maxed out? No savings for emergencies you PRAY will never happen? A houseful of UTTER crap you don’t use? (Except for the bling. Bling is a necessity. Like food.)

Gird your loins for the tough-love:

WHAT ON EARTH IS WRONG WITH YOU?

Honestly!

If your finances are a mess, you’ve got three options:

- get a higher-paying job

- stalk and bag a rich partner who’ll swear their undying love AND bank account to you

- organize your money so you stop spending more than you earn

Quite obviously, luvbugs, the last option is the most realistic. And you can start doing it right away ONCE you know how much money you actually have.

The way to calculate that is simple. It is the amount of money you get paid into your bank account each month. THAT is the money you actually have for that month.

It is NOT that money plus the maximum amount you can put on your credit card.

Too many people spend money they haven’t earned, to buy things they don’t want, to impress people that they don’t like.

Will Rogers

You’re not alone though, my little chickadees. MOST of us deal with the same reality twelve times a year.

The money that comes from our employer to our bank account each month IS the money we have. It’s what we will pay our bills with. It’s what we will get through another thirty days on.

When you accept the reality of how much money you actually have each month, you can start organizing THAT AMOUNT.

And when you’ve organized that amount you WILL stop spending more than you earn.

5 Easy Ways to Organize your Monthly Finances STEP 2: Budget by Getting an Online Bank that Allows Multiple Accounts.

Jesse Orrico

Jesse OrricoOnce you know how much money you get each month you can budget that money. And there’s a very simple way to do that within your online banking.

First you need to actually HAVE online banking. Long gone are the days of joining a bank because it had a bricks and mortar branch down the street.

There are a LOT of choices now. So shop around for the online banking that gives you exactly what you want.

Make sure your online bank allows you to open and use multiple savings accounts. The bank should NOT charge fees for either opening or using those online savings accounts.

And you don’t need a laptop or computer for online banking. Downloading your bank’s online banking app on your smart phone will work just fine.

PRO TIP: Open multiple SAVINGS Accounts in your online banking rather than multiple Current Accounts. And make sure the Savings Accounts have NO limit on the number of withdrawals per year. Savings Accounts usually have lower fees and no overdraft facility–so you can’t overdraw your account and go over your budget. Or get charged fees by the bank for overdrawing.

Then follow these set-up steps:

- have your employer pay your wage or salary paid directly into an account in your online banking. You’ll be able to name that account. So name it something like ‘Salary Account’

- make a list of all the bills you pay each month AND throughout the year (as some bills come every quarter or once per year)

- within your online banking open one account for EACH of these bills

- name each account accordingly. You’ll end up with names like Phone Bill Account, Rent Account, Medical Insurance Account, Electricity Account and so on

- Make THREE additional accounts. Name one ‘Groceries Account’. The other ‘Savings Account’ and the other ‘Fun Account’

Simple, right? Well it is normally. Though it CAN take a bit of getting used to your online banking system.

The more you use your online banking, the more familiar and EASIER it becomes.

Which brings us to the next step on the glittering road to organizing your monthly finances and making your money sparkle!

5 Easy Ways to Organize your Monthly Finances STEP 3: Automate Your Account Transfers and Your Bill Payments.

Carlos Muza

Carlos MuzaYou’ve set up your multiple accounts in your online banking. Now it’s time to crack the whip and tell them what to do each month.

First a couple of simple calculations. And the power of online banking automation means you need to do these only ONCE.

- next to the name of the each monthly bill write the approximate amount of the bill. Amounts sometimes vary so write the higher amount here

- for bills that come every other month, or quarterly, or semi annually or annually calculate the total you pay for the YEAR for that bill and then divide by 12 to get the amount you need to put away monthly for it

Now the fun part!

Go into the intricate belly of your online banking and set your Salary Account to transfer the monthly amount for each bill into its corresponding savings account.

So if your maximum monthly phone bill is $55 maximum, your Salary Account will automatically transfer $55 to your Phone Bill Account each month.

Set this up for EACH of your bill accounts, including the accounts that have quarterly, bi-annual or annual bills.

Pat yourownself on the back for getting this far. But don’t reach for that well-chilled bottle of French Chardonnay yet, poppets.

It’s time for the SECOND fun part.

Delve BACK into the belly of the beast and set each of your bill accounts to pay the bills automatically each month.

Now, this feature may not be available for ALL of your bills. But it should be available for most.

The worst case scenario is that you will need to log into your online banking once a month to pay a couple of bills manually.

But that’s a good thing, chickadees.

Because you SHOULD be casting some critical side-eye over your financial empire at least once a month.

PRO TIP: Timing is everything. Most of us receive our wages or salary on the same date each month. Set your Salary Account to transfer the bill amounts to their corresponding Savings Accounts on the same day as your salary comes in. Or within one to two days maximum if you need a bit of leeway. THEN set your bills to pay within one to two days after that. Once the money goes out, you won’t be able to raid your earmarked funds for that impulse pair of Jimmy Choos . . . unless you really try.

Now, Miss Cee’s not gonna sugarcoat it for you.

Getting this set all up was a COMPLETE nightmare. They were some of THE most frustrating times EVER. For the bank’s call-center staff.

But be kind to yourownselves, luvbugs. Set aside a day (or two) to get your online monthly finances and budget set up.

Take your time.

Chant your mantra.

Drink a LOT of chamomile tea.

Put vodka in it.

It is totes worth it in the end. TOTES.

Okay then. The next stage in making your monthly finances pristine, glowing and sparkling is skoolin’ yerselves in how to use yer bank cards.

5 Easy Ways to Organize your Monthly Finances STEP 4: Use Your Debit or Credit Card the Right Way.

Avery Evans

Avery EvansHere’s a rule that will help you go through life like a hot knife through butter and NOT like the Titanic through the North Atlantic:

You only need ONE card. Be it a debit card or a credit card.

JUST ONE.

Got it?

Good.

Let’s start with debit cards as they are simplest.

In Step 2 above Miss Cee suggested opening 3 Savings Accounts in addition to those for your bills. One of these is your Groceries Account.

ONLY get a debit card for your Groceries Account.

You do not need a card for ANY of your other bank accounts. Here’s why, kiddies:

- with a debit card you can only spend what is in the account and no more

- debit cards normally have very low yearly fees. Something around $25 annually or even less

- all of your other bills will be paid automatically or payable by going online once a month and doing a quick internet banking transfer. There is no need to have any cards for those bill accounts

- when your only card is used for buying your groceries you are MUCH less likely to whip that card out on a catastrophic whim at Tiffany’s

Tough love time again:

When your grocery money on your debit card runs out so does your food, hunny.

The Starvation Diet is VERY effective but COMPLETELY horrific. You’ll only have to be on it once before your discipline with your debit card becomes IRON.

That or your mother wonders why you show up for dinner 20 nights in a row each month.

PRO TIP: Knowledge is power. Organizing your money means you know EXACTLY how much is available for groceries each time you hit the supermarket. If you have $600 for the month and shop once a week you can spend $150 each time. If you shop daily you’ve got about $20 to spend. Whatever amount you have, you KNOW it before you set foot in the coffee aisle. So you’re much less likely to overspend.

On to credit cards.

When you’re young and stupid innocent and get your first credit card you think, Gee. Look at this huge spending limit the credit card company has given me. Isn’t that KIND of them! God, I’m important. I wonder if Prada delivers . . .

Put your sequin dress back on, schlepp to that mirror and take ANOTHER hard look at yourself.

Your bank or your credit card company is a business. And like ANY business their job is to get as much of your money as they can.

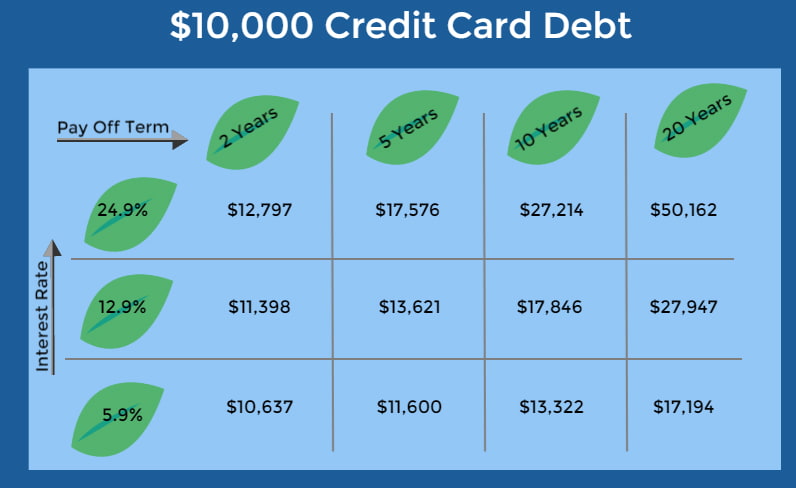

If you don’t pay off everything on your credit card at the end of each month and opt instead for the minimum payment then you are ALSO paying interest.

A terrifying amount of interest. Which quite frankly should be illegal.

It can be 16% to 36%.

Compound.

Which means you’ll pay interest on the interest.

via the very SANE peeps at Credit.org

via the very SANE peeps at Credit.orgSo if you whack $10000 on your credit card and then choose the minimum monthly payment you may need 20 years to pay off that $10000.

And at that point 20 long TEDIOUS years from now you’ll have paid back a mind-blowing $50000.

The amount you borrowed PLUS FOUR TIMES MORE.

Or as Dracula would say, ‘Bwahahaha. Thanks for your blood.’

Miss Cee, on the other hand, isn’t saying that credit cards are ALL bad. Let’s say you travel a lot and want to redeem as many airline miles as possible.

Let’s also say you find a credit card that gives you air miles for every dollar you spend on the card.

And THEN let’s say you can put almost ALL your monthly bills through that credit card . . .

Well then go for it.

BUT you need to be very organized. To keep your credit score healthy don’t use more than 10% of the limit on the card. And pay all those bills off at the end of EACH month.

And if you’re just a little fluffy chick hatching out of the safe nest of home for the first time avoid getting a credit card.

They are best left for the more financially experienced.

Or the very old and about-to-kark-it who can pass the debt onto their unsuspecting chilluns.

5 Easy Ways to Organize your Monthly Finances STEP 5: Budget for Fun and Tidy Your House.

Flavio Shibata

Flavio ShibataYou’re gonna feel GOOD! Miss Cee can tell you that right now. G-O-O-D!

Organizing your monthly accounts. Getting your money into sparkling good order.

You’ll be super chuffed and patting yourself on the back with BOTH hands.

Now, back in Step 2 above, Miss Cee suggested opening three additional savings accounts. Two of them were your Fun Account and Savings Account.

Why fun? Why the HELL not! Look kids, you can get as sparkly and organized as you want but you also gotta have some good tiiiiimes.

It doesn’t have to be expensive fun.

It could be as simple and cheap as movie, or a glass of wine with the girls. Perhaps a big weekend roast beast for the whole fambly as Grandma Quin is wont to do DESPITE Quin get-togethers making August: Osage County look like a Disney musical.

PRO TIP: Tidy up, dammit. Throw out or donate things you don’t use. Forget about trying to work out which possessions or clothes ‘spark joy’. Just toughen up, Princess, and tidy like you’re about to move out. You’ll be amazed at all the UTTER crap you have. And all that clutter used to be money, as the saying goes. The HORROR you’ll feel at the waste will tame any future overspending.

WHATEVER your fun is, budget for it and set aside some money each month through your automated online banking system.

When it comes time to spend that money you’ll have to go online and transfer it to your Groceries Account. Because THAT is the account with your debit card connected.

This extra step, quick though it may be, is important. It means your fun money is not available whenever the latest fancy grabs you by the short and curlies.

It helps you plan your spending.

And the more mindful of your money you are, the less you will overspend. You’ll find it easier to SAVE, too.

Because your Savings Account is not just important.

It’s a necessity.

Only 41% of Americans are able to cover a $1000 emergency with savings.

CNBC

If you don’t have enough savings to cover an emergency you’ve got two choices. Go cap-in-hand and borrow money from relatives OR get a credit card.

Neither of those is a fabulous option for your self esteem or your financial health.

So squirrel a bit away each month with your automated online banking system.

For peace of mind.

5 EASY Ways to ORGANIZE Your Monthly FINANCES Conclusion

5 easy ways to organize your monthly finances WILL make your accounts squeaky clean and sparkling.

Yes, you WILL have to do a bit of setting up.

But once that is out of the way your monthly accounts will be organized AND automated.

Best of all, you’ll know how much money you have every month and where it is going.

Be sure to check in to your online account once a month. You you’ll need to make adjustments here and there.

But pat yourownself on the back again. You’re a CHAMPION!